The story of One Niagara, a massive tourist complex near the iconic Falls, is not one of civic triumph but a shocking lesson in audacious financial manipulation. Known locally as “The Cube”—a hulking, windowless structure—it was designed to be a revitalization project. Instead, it allegedly became a multi-million-dollar cash-skimming operation, a testament to the fact that sometimes the only thing flowing faster than the Niagara River is untraceable cash.

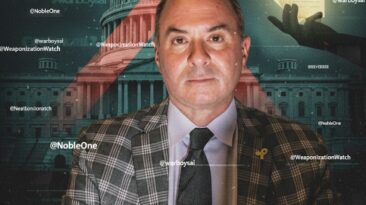

Frank Parlato Jr., the alleged mastermind, famously boasted that he built The Cube “without a dime of taxpayer money.” This boast, in retrospect, sounds less like pride and more like a declaration of intent to keep the taxman’s fingers out of the till. The genius of the operation was its relentless focus on cash-intensive tourism. As a “welcome center,” it housed parking, cheap souvenirs, and overpriced food stands—a series of highly lucrative tollbooths constantly churning revenue from the millions of visitors to the Falls.

The Cash Volcano

The sheer volume of this alleged cash flow transforms the operation from petty crime to an industrial-scale financial ballet. Testimony from a private investigator, working for a disgruntled investor, revealed the shocking scale: at least $130,000 in cash was observed exchanging hands in a single August month. This wasn’t a small business; it was a miniature cash-dispensing volcano.

To facilitate this flow, Parlato allegedly implemented an elegant, old-school system with the on-site vendors. Instead of neat, trackable fixed rents, vendors were often required to pay a percentage of their gross revenue—frequently, and crucially, in cash. This arrangement created a meticulously dismantled paper trail, with stacks of twenty-dollar bills vanishing into a dark corporate hole.

This brings us to the mechanism of the crime: IRS Form 8300. Federal law mandates that any business receiving over $10,000 in cold, hard cash must file this form to prevent the hiding of income. The indictment against Parlato was a thing of beauty, revealing his “willful failure to file” these forms. This is the classic maneuver known as “structuring”—a calculated effort to keep payments just under the radar, burying a mountain of money one transaction at a time.

The Shell Game

The truly audacious part of the scheme was the corporate performance happening simultaneously. While the cash-skimming machine was humming, the corporate entities surrounding One Niagara were pleading financial distress. They were, at one point, over $600,000 behind on property taxes and filed for Chapter 7 Bankruptcy in 2011.

The strategy was the financial equivalent of a shell game: use complex structures like One Niagara LLC and Whitestar Development Corp. to compartmentalize liability. The messy parts were allowed to go bankrupt, while the cash machine kept merrily along, allowing the tourism revenue to flow directly into a great, black box.

The Anticlimax: A Whimper, Not a Bang

For all the industrial-scale cash flow and the cinematic “structuring” schemes, the legal hammer came down with a surprisingly soft thud.

In 2015, federal prosecutors threw the book at Parlato, hitting him with a thunderous 19-count indictment that included fraud, money laundering, conspiracy, and obstruction of the IRS. It looked like the end of the line. But the wheels of justice ground slowly—agonizingly so.

After nearly a decade of legal wrangling, delays, and dismissed charges, the “Cube of Contempt” saga didn’t end with a dramatic trial, but with a quiet signature on a plea agreement. In August 2022, the 19-count indictment was whittled down to a single guilty plea. Parlato admitted to one count of “willful failure to file a return involving cash transactions of more than $10,000.”

Specifically, he admitted to taking roughly $20,000 in cash rent from a vendor in 2010 without filing the required Form 8300.

The sentence? No hard prison time. In July 2023, Parlato was sentenced to one year of supervised release, including five months of home detention, and ordered to pay restitution. He also agreed to forfeit approximately $1 million that had been seized—a stinging loss, perhaps, but a fraction of the cash flow that once churned through the One Niagara complex.

In the end, Parlato walked away from the wreckage of the 19 counts relatively unscathed, proving that in the high-stakes game of corporate shell games and cash skimming, sometimes you don’t have to beat the rap—you just have to outlast it.